Consistent product quality is the most proven predictor of any manufacturer’s success. Competitors may imitate each other’s marketing, but superior quality stands alone as the truest statement of company’s values. That is why forward-thinking manufacturers are making quality cost management part of their core existence.

Engraining the fundamentals of quality cost management across every plant and production line creates guardrails that keep quality improvement on track. Moreover, it leads to improved product quality and increased yield rates, fostering customer goodwill. That is why manufacturers who have embraced quality cost management are driving higher customer demand and loyalty—and greater profits—than competitors spending millions of dollars to market mediocre quality products.

Calculating Cost of Quality

Knowing the cost of quality (COQ) is essential to earning and keeping a reputation for excellence, nurturing customer trust, and growing over time. Since it represents all the costs associated with stabilizing and continually improving product quality, from suppliers to customers, COQ is the single best metric for tracking how well manufacturing is delivering on the commitment to exceptional quality. It is common to see cost of quality account for 15% to 30% of a manufacturer’s sales, and between four to six times the size of net profits a given year.

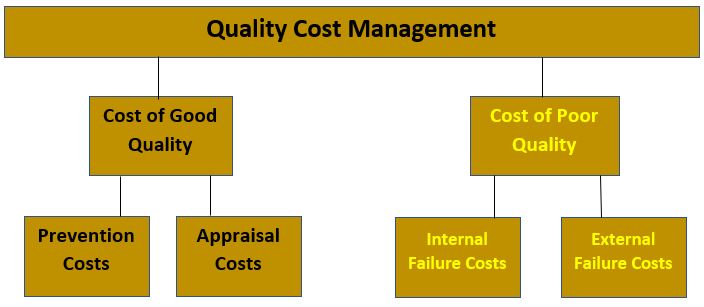

Total COQ is the net difference between cost of good quality (COGQ) and the cost of poor quality (COPQ) and is considered the definitive quantitative measure for ensuring continuous quality management and improvement. COPQ includes internal failure costs and external failure costs while COGQ is comprised of appraisal and prevention costs.

Cost of Good Quality

First, we look at the elements that comprise COGQ: appraisal costs and prevention costs.

Appraisal costs include the expenses related to customer- and industry-specific audits, testing, and industry certification audits to confirm products are meeting and excelling at specific quality standards for the industries and specific markets served. Appraisal costs are best quantified by the percentage of equipment costs, software costs, and total employee costs by production line or product of interest.

Commonly, manufacturers in highly regulated industries such as aerospace and defense, medical device manufacturing and pharmaceuticals are performing up to 70 internal audits a year as a part of their ongoing quality management programs. The more regulated the industry is, the more investments in appraisal costs are seen as essential to the operation of the business, and the more effort is put into quantifying them. By contrast, many manufacturers in less regulated industries only track COPQ, but they are missing vital information they could use to strengthen their overall product quality and drive down the cost of poor quality.

Prevention costs typically account for the largest percentage of COQ and are the easiest to track in many manufacturers. They include audit management, continuous improvement project teams, corrective and preventive actions to the product line level, quality planning to the product and production line level, risk management and all costs related to reducing scrap, return material authorizations (RMA), and other associated costs. Just as with appraisal costs, prevention costs are also tracked by the percentage of equipment, software, and employee costs.

Prevention costs associated with COGQ can significantly reduce the external failure costs related to COPQ. For example, with COVID-19 multiple manufacturers have pivoted from producing automotive products to making much-needed personal protective equipment (PPE). On average, these companies represented spending more than 10% of their total quality budget on preventative costs, which has yielded a 42% reduction in external failure costs.

Cost of Poor Quality

Two dimensions affect COPQ: internal failure costs and external failure prevention costs.

Internal failure costs include the costs of rework, retesting, and recertifying machinery and tools in the event there is a high percentage of returned orders. Most manufacturers have frameworks in place for knowing, in aggregate terms, their internal failure cost (IFC) levels over time. IFC is a pivotal metric in the overall COQ calculation as it reflects how well a manufacturer is managing supplier quality, inspection and staying in compliance with industry, regional and national regulatory requirements in every country they operate in.

It costs 7x more on average to recover from product quality problems once a manufacturer has taken delivery of a part, assembly, or entire product configuration. For this reason alone, keeping continuous monitoring and quality improvement tools such as REVEAL Plant Floor Intelligence software, a proactive real-time shop floor tool, in place makes both logical and financial sense with improving COPQ by 33% on average at current installations.

External failure costs are the costliest components of COPQ. At a minimum, they damage customer trust, and they often lead to recalls or even lawsuits over product liability. One example is General Motors, in which GM recalled 26 million autos plus set up uncapped $400 million fund designed to compensate for deaths and injuries caused by faulty switches, which had led to 13 deaths, and 31 car accidents. Therefore, external failure cost (EFC) needs to be a part of every COQ calculation.

Conclusion

Knowing every cost component of the cost of quality is no longer optional. We are in an always-on, transparent world where customers everywhere at any time can take to a social media platform and share their experiences. By engraining COQ across all manufacturing operations, having proactive tools such as REVEAL real-time process visualization delivering complete visibility into not only production operations but also supply chain which naturally drives better control of per-unit production costs, achieves greater efficiency in manufacturing operations, and increases production First Time Yield (FTY). Moreover, knowing your COQ helps manufacturers troubleshoot supplier quality and service quality, reducing return material authorizations and controlling external failure costs. With these factors in mind, it is clearly time for manufacturers to make cost of quality a core element of their existence, be the Smart Factory, and move to Industry 4.0 today.